The biggest mover so far this morning on the stock market is TSHA – Taysha Gene Therapy. They’re making huge moves up almost 50% before noon EST.

If you’re not yet familiar with this company, the name alone tells you that they’re engaged in gene therapy. But more specifically, they engage in the development and commercialization of adeno-associated viruses based gene therapies. They seek to help their patients through treatment for monogenic diseases of the central nervous system.

And right now, their sights are mainly set on developing treatments for Rett’s Disease – a rare genetic brain mutation affecting mainly young females. So – what’s the latest breakthrough that’s sent their share prices skyrocketing?

A strategic partnership with Astellas Pharma – a Japanese company that is also engaged in pharmaceutical product research, development, manufacturing, & import/export. While Astellas primarily focuses on cancer-based drugs, they’ve taken an interest in what Taysha is doing. So much so, in fact, that they’ve aligned with the company and invested a whopping $50 million. This is a 15% stake in the company.

This funding will further Taysha’s research and development of drugs like TSHA-102 for Rett syndrome and TSHA-120 for GAN. The kicker is that should either of these treatments pan out and make it through clinical trials, Astellas will have the exclusive option to license the drugs. Astellas will also gain a seat on Taysha’s board of directors.

Both companies issued statements showcasing their excitement in regard to this deal. And obviously, investors are excited too. The speculation on this deal alone has sent TSHA’s stock price from $1.48 yesterday at market close to $2.36 – and counting – this morning so far.

From Taysha’s standpoint, this couldn’t have come at a better time. In fact, analysts are saying this could be their last chance. The company is down 85% over the last year even with today’s huge spike. Their IPO debuted at $20/share – and the company sits at a fraction of that price today. This is mainly because Taysha has been unable to get a drug to market since going public.

So – as an investor, what should your next move be for TSHA? Obviously, there is still much to be seen as far as what the company can do with this funding. Until a drug makes it through clinical testing and gets to market, any sort of investment would likely be speculative. However, we can take an unbiased, emotionless look at TSHA stock through VectorVest’s stock forecasting software. This will give you a clear buy, sell, or hold rating so you can execute your next move in confidence.

3 Major Concerns With TSHA Stock Through the VectorVest Viewpoint

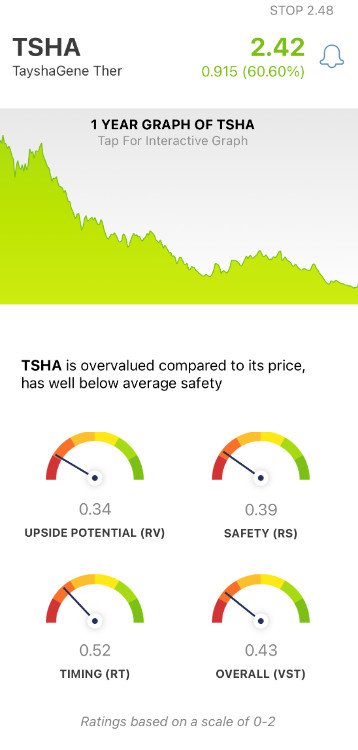

VectorVest simplifies trading for you by compiling all pertinent information about a stock into just three easy-to-understand ratings. These are relative value, relative safety, and relative timing. All three ratings sit on a scale of 0.00-2.00, with the higher end of the range indicating better performance. This makes it easy to analyze a stock with sound, tried-and-true principles.

What’s more, VectorVest can provide you with an overall VST rating based on these three ratings. This also comes with a clear buy, sell, or hold recommendation. So, what’s VectorVest’s current viewpoint on TSHA?

- Very Poor Upside Potential: The long-term price appreciation potential for TSHA is weak, and they’ve scored an RV rating of just 0.36 – which is very poor. Moreover, the stock is way overvalued at its current price of $2.26. VectorVest calculates a current value of just $0.69.

- Very Poor Safety: An indicator of risk, RS looks at a company’s financial consistency and predictability, debt-to-equity ratio, and business longevity. As for TSHA, the RS rating of 0.39 is very poor.

- Very Poor Timing: It’s true that the TSHA share price is skyrocketing today. However, the RT rating takes into account not just day-over-day price movement – but analyzes the direction, dynamics, and magnitude of a price trend week over week, quarter over quarter, and year over year. And as we mentioned earlier, TSHA has a huge hole to climb out of. As a result, the RT rating they’ve been given of 0.41 is very poor.

All of this considered, the overall VST rating of 0.39 is very poor. So, what does that mean for you if you’re currently invested in TSHA – is it time to sell and take profits? Or, is the stock rated a hold upon the release of the Astella deal? To gain a clear answer on what your next move should be, get a free stock analysis here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TSHA, it is overvalued with very poor upside potential, safety, and timing – even with the news regarding the Astella deal

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment