Many people make a good effort to invest and save up for their retirement during their working years. While it is very clear to see the advantage of investing early for retirement, your investing efforts shouldn’t stop just because you’ve entered retirement.

As you make this transition to a new stage of life, you still need to be strategic about your investments and learn specifically how to invest after retirement begins. With your investment goals and timeline shifting at this point, you may put less emphasis on long term trading and saving for the future. After all, you need to find investments that will benefit you and generate a steady and reliable income now.

Continue reading through this guide as we cover the best investments for retirement income, and why you should continue investing during retirement in the first place.

Featured Courses:

Can You Really Earn Additional Income From Your Retirement Investments?

Before we dive into what are the best investments for retirement income, you may wonder whether it’s even possible to earn supplemental income from retirement investments. Some people have the belief that the sum of money they had saved up when they entered retirement will need to be eked out over the years to support them until the end of their life.

While it is important to have a good amount of money saved up before you can be comfortable enough to retire, there are also ways to continue investing and earning income on your nest egg throughout your retirement.

The truth is, there are many different types of investments for retirement. However, only the right ones will help you continue growing your money and provide you with additional income throughout retirement. So, you need to select the right investment strategies for retirement to actually reap these benefits.

Why You May Need to Seek Out the Best Investments for Income in Retirement

So, why would you need to know what the best investments for income in retirement are? The truth is, it’s very common for retirees to run out of money during their later years. If you don’t plan and save up properly throughout your career or if you time your retirement incorrectly, you could end up in a situation where you don’t have enough money stashed away to support yourself without a salary.

At the same time, there are many unexpected circumstances and expenses that could arise during your retirement. It’s a fact that spending on medical expenses increases as you age. There are countless other emergency situations that could arise like your car breaking down or roof replacement that would cost a sizable sum of money.

Plus, your lifestyle and spending habits could change once you’re in retirement. Maybe you decide you want to travel more than you originally thought. Or, maybe you underestimated the cost of spoiling your grandchildren! In either case, you’ll need more cash than you may have initially anticipated.

For all of these reasons, it’s a good idea to seek out the best investments for income in retirement to ensure you don’t have to stress about money. After all, you’ve made it to retirement – your days should be spent relaxing and enjoying all you’ve worked for!

So, What are the Best Investments for Retirement Income?

With all these points in mind, let’s list out the best retirement investments for income. There are plenty of options out there when it comes to investing for retirement income; however, the following securities should be near the top of your list for consideration.

U.S. Treasury Bonds

Treasury bonds offer retirees a stable and reliable source of income. They pay a fixed rate of interest every few months until they mature, and are issued with 20 or 30-year terms. Thus, they can be a great investment to generate income, especially if you’re just entering retirement in your sixties.

Investors can purchase Treasury bonds online for themselves or through a brokerage. Either way, these securities are backed by the U.S. Treasury, therefore they’re seen as one of the most trustworthy and reliable investments in the world.

REITs

Another good investment opportunity that provides income for those in retirement is with real estate investment trusts, or REITs. These only invest in real estate funds that are involved in the purchase and management of the residential, industrial, or commercial real estate, or hotels.

These are generally good income-generating investments because they are required by law to pass on at least 90% of their taxable income to shareholders in order to qualify for a generous tax break by the government.

Thus, the dividends that shareholders receive on these investments are a great reason why you would want to invest in them during your retirement. Plus, they give investors exposure to the real estate market without having to purchase or manage properties for themselves, and REITs add great diversification to your overall portfolio

Publicly-traded REITs can be bought and sold on the stock market, so they’re easy to trade on your own at any time just like equities.

Mutual Funds

Mutual funds can also be a good idea for income-generating investments during retirement.

There are a large variety of mutual funds available, so they aren’t all necessarily going to provide good income levels or be a good fit for those in retirement.

However, investors can target the right mutual funds that match their investment timeline, age, and risk tolerance to provide them with the income and returns they need given the stage of life they’re in.

Stocks

Lastly, a simple and effortless way to help you generate income from investments during retirement is to invest in stocks, or equities–you just need the right tools and resources to help you discover winning stocks.

The good news for retirees is that there’s always money to be made in the stock market, no matter if the current trends are bullish or bearish. However, investors need to have the proper analysis tools at hand to help them identify the stocks that are showing good upward potential–and provide attractive dividend yields.

When investing in income-generating stocks that provide shareholders with dividend payments, investors are rewarded for their investment through shared company profits and can receive a sizable income each quarter depending on the stocks in their portfolio.

So even though many people will rely on equities to build up the value of their portfolios in the years leading up to retirement, they can also provide an excellent source of income during retirement. However, it’s important to note that not all stocks will pay dividends, which is something you’ll need to scan for while you’re picking out which stocks to invest in.

Which of the Best Retirement Investments for Income Should You Allocate Cash Towards?

With all these great investments in mind that can generate income for you during retirement, how do you know which will be the right option for you? While each security offers different benefits to retirees looking to generate investment income, stocks have many advantages that the other types of investments do not have, which we’ll discuss in more detail below.

Why the Stock Market is the #1 Choice for Retirement Investment Income

Amid all the other investment options, the stock market continues to be a popular choice for retirees who want to earn income from their investments.

At this stage, diversifying your assets should be one of your main priorities. Diversification provides you with added protection from price volatility should one security experience major losses during a given period. Especially during retirement when your investment timeline has shortened, this is a very important feature for your investments. This is because you no longer have the time to recoup potential losses as you did earlier on in your career–you need a reliable investment choice that will still generate income for you.

Because of this, investing in the stock market is a great idea because you can diversify your portfolio based on the stocks you hold to master the right blend of safe, dividend-paying stocks, and higher-risk growth stocks. Whether you’re learning how to hedge hyperinflation or you want to learn swing trading, the stock market can help you accomplish each of these strategies, while still generating positive returns and dividend payments no matter the market conditions.

So even though each of the investment options listed above can be great at providing income, few offer as many upsides and diversification as investing in the stock market.

How to Get Started

Picking stocks and executing profitable trading isn’t nearly as complex as you may think. With the right tools, anyone can leverage the stock market to their advantage and start trading for a profit.

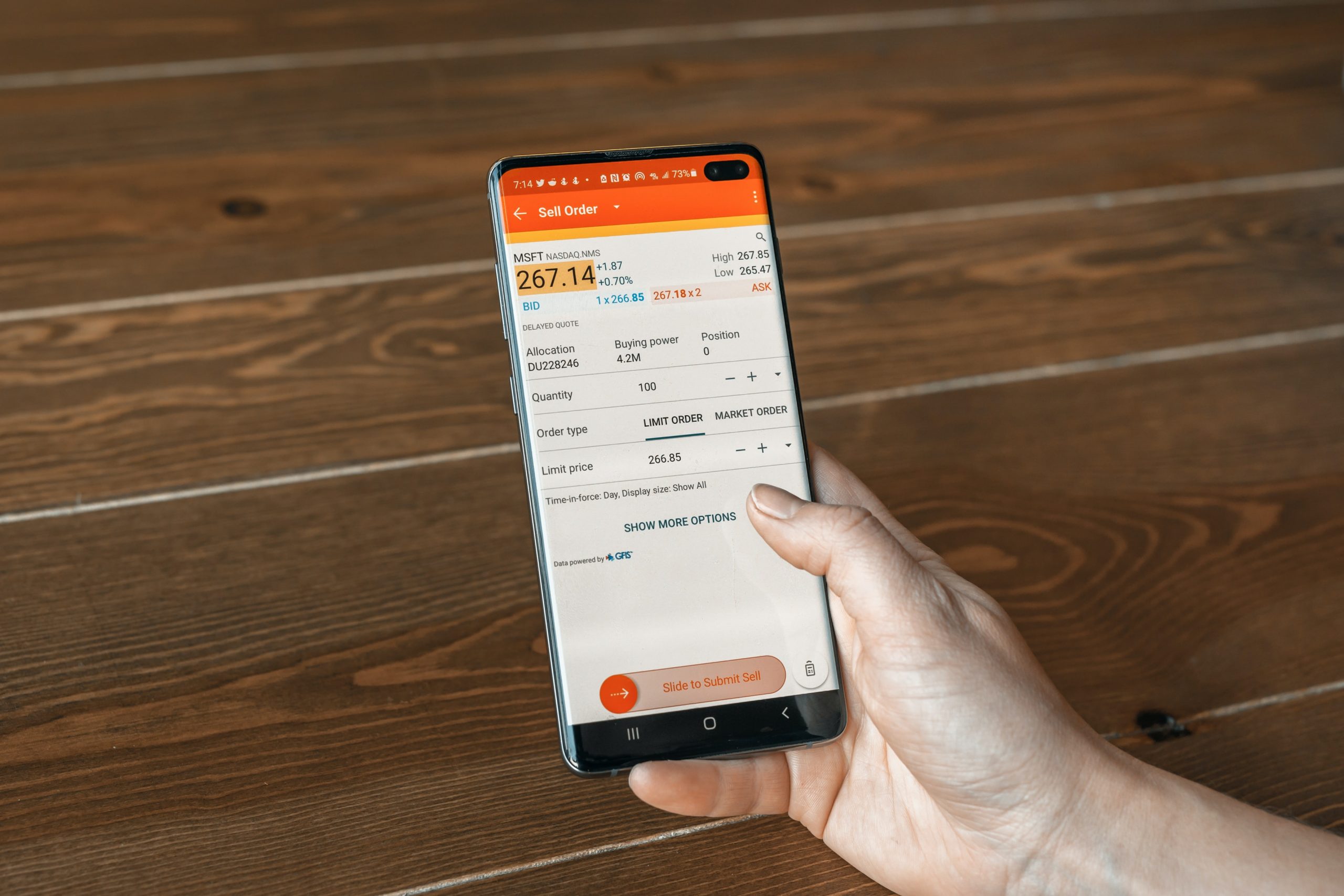

First, you need to learn as much as possible about the markets and do the proper background research on stocks before making an investment decision. With VectorVest, you can utilize our stock forecasting software and mobile stock advisory to do all the necessary research in order to run a profitable trading strategy.

Then, you can start investing using VectorVest to help you accurately time the markets, identify worthwhile investment opportunities and know when to buy and when to sell. This is invaluable information that can make or break your investment strategy, and thus your retirement, and you can access it all in one place with VectorVest.

With VectorVest, your dream retirement lifestyle can quickly become reality. Don’t feel limited to a fixed income during your final decades–live the life you’ve always dreamed for yourself while fueling your lifestyle with the income from your investments. So say goodbye to the stress and uncertainty that many associate with retirement finances, and utilize VectorVest to unlock new streams of income. You’ve got this.

Closing Thoughts on the Best Investments for Retirement Income

Clearly, there are many different types of investments that retirees can make that will continue generating income for them. So just because they’ve entered retirement doesn’t mean they should shut down their investment strategies–they just need to readjust their sites to focus on their revised investment goals and timeline.

With VectorVest, you can confidently invest in the stock market for maximum income and returns during your retirement. Accurately time the markets with precision and identify winning stocks to give yourself the extra income you deserve during retirement to live the life you’ve always wanted.

Visit VectorVest today to get started and receive a free stock analysis.

Leave A Comment