There’s positive news for Applied Materials, a semiconductor equipment vendor that beat earnings targets for first-quarter fiscal 2023. The company earned an adjusted $2.03 a share on $6.74 billion in sales – above analysts’ expectations of $1.93 a share on sales of $6.69 billion and Applied Materials’s own prediction of $1.84 a share on $6.4 billion in sales year over year.

Despite the strong performance, AMAT stock alternated between gains and losses during regular trading before closing at $115.44 as investors weighed up potential risks to the industry and economy alike going forward into the second quarter of 2023 and beyond.

Year over year, Applied Materials is up 7%. It’s the eighth biggest semiconductor equipment stock in terms of market capitalization. Yet, there are supply problems looming in the sector. For example, MKS Instruments, a partner of Applied Materials, experienced a ransomware attack that has delayed shipments to customers, including Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co., the two biggest chip makers in the world. This could lead to $250 million less in sales in the second quarter for Applied Materials.

Moreover, the global chip shortage and rising raw materials prices could also pose challenges to Applied Materials and any other semiconductor company. How it’s impacting Intel Corp and ASML Holding NV, two of the company’s key customers, is still unclear.

Ultimately, it looks like Applied Materials will have to navigate a few headwinds if it wants to continue its positive sales trajectory and maintain its competitive edge in the semiconductor industry. While competitors in the semiconductor equipment market are reducing their budgets for new equipment, the upbeat performance from Applied Materials is a bullish sign for an industry with serious challenges ahead.

During the pandemic, Applied Materials has managed to maintain steady sales growth, which can mostly be attributed to its decision to focus on supplying end-market customers such as carmakers and smart device makers. This strategy appears to have paid off and enabled the company to outperform many of its competitors in the semiconductor equipment industry.

Going forward, Applied Materials will need to leverage its extensive network of suppliers and partners, along with the expertise of its research and development teams, in order to remain competitive amid rising costs. The company has already taken steps to address the chip shortage by opening new manufacturing facilities in Taiwan and China. However, that doesn’t guarantee the company’s future success, as the materials needed to fabricate semiconductor components remain in short supply.

Semiconductor manufacturers still face deficits and potential trade restrictions, creating an uncertain future for the industry. But Applied Materials is in the game and appears to be doing everything it can to remain competitive and profitable. Due to proposed US trade restrictions, Applied Materials expects a $2.5 billion revenue loss in Q2. Despite this, the company is staying optimistic and believes that as China resumes sales for essential materials needed to fabricate semiconductor components, Applied Materials will be able to ride out the storm and remain a leader in the industry.

There's Mixed News About AMAT and Investors Are Uncertain—How Should They Feel About This Stock?

There is certainly mixed news surrounding Applied Materials at the moment. On one hand, the company has seen strong sales growth and outperformed competitors in its industry. On the other hand, there are risks associated with increasing raw material prices, chip shortages and trade restrictions that could cause a significant revenue loss for the company. To determine whether AMAT is a potentially good investment, let's look at the stock using VectorVest's stock forecasting tool.

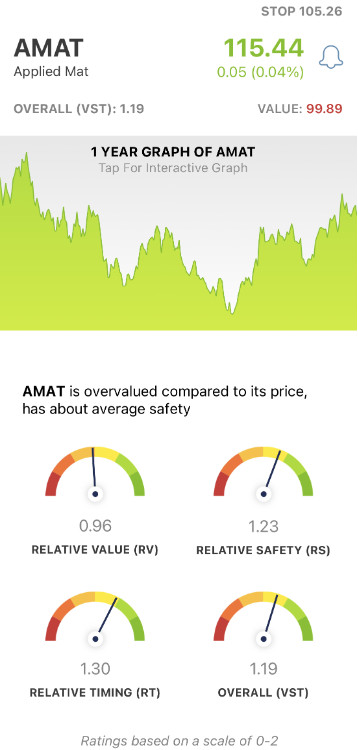

The VectorVest system changes the way you trade for the better. It tells you everything you need to know about a stock in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Gaining insights from these ratings is fast and straightforward, as they sit on a simple scale of 0.00-2.00. Pick stocks with ratings above the average of 1.00 and win more trades!

Making things even easier, the VectorVest system provides you with a clear buy, sell, or hold recommendation based on these ratings. No more guesswork, no more emotion clouding your judgment. As for AMAT, here’s the current situation:

- Fair Upside Potential: On a scale from 0.00 to 2.00, VectorVest gives AMAT a RV of 0.96. This means that the stock has the potential for a moderate upside, but it’s not the most attractive option at this moment. While it calculates the current value of AMAT as $99.89, the stock currently sits at $115.44, meaning it's overvalued.

- Good Safety: Although the upside potential is fair, VectorVest believes that the stock provides a good level of safety, with an RS rating of 1.23. This is calculated based on the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: Analysis of AMAT's relative timing should give confidence to investors. AMAT's Relative Timing score is 1.30 on a scale from 0.00 to 2.00. This rating is calculated based on the trend’s direction, dynamics, and magnitude. It’s analyzed day over day, week over week, quarter over quarter, and year over year so you have the full viewpoint.

Altogether, AMAT receives a good overall rating of 1.19. Does it earn AMAT a buy in the VectorVest system, though? To get a clear answer on your next move with this stock use our free stock analyzer here.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for AMAT, it is overvalued with fair upside potential, good safety, and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment