Beyond Meat (BYND) has had a brutal start to the week as the stock has slid almost 19% over the past few days.

This came on the heels of a dismal earnings day in which the company missed revenue expectations, cut its full-year forecast, and walked back its goal of seeing positive cash flow in the latter part of this year.

The meat substitute company boomed when it IPOd back in 2019, but since reaching a high of $234/share it’s been a steady fall to grace. Today, shares sit at just $12.62.

This can all be attributed to weak demand. US retail volume has fallen more than 34%, and the food service segment fell 44%. This led to a 30.5% drop in revenue for the second quarter, as the company reported just $102.1 million – a bit under the estimate of $108.4 million.

Realizing that demand is dropping rapidly, the company slashed its full-year revenue forecast from the previous $388 million to now just $360-$380 million.

CEO Ethan Brown says that demand has been afflicted by “special interest groups seeding fear and doubt about the health and safety of Beyond Meat products”. Whether the concerns these groups raise are valid or not is a separate discussion.

In order to keep the lights on as demand declines, the company has made efforts to bolster profitability. It cuts costs wherever possible – but these efforts have been nothing more than treading water, as the company has had to cut its prices as well to attempt to spur demand.

As a result of this, Brown said the company’s goal of turning a positive cash flow by the second half of this year will be delayed. All things considered, the future looks fairly bleak for Beyond Meat.

BYND had actually been trending in the right direction leading into this news, though. The stock climbed almost 40% in a 3-month span before losing nearly all that growth over the course of 3-4 weeks.

That being said, is it time for you to move on and cut losses on BYND? Or, is there any reason to hold onto hope that things will turn around? We’ve taken a look through the VectorVest stocks software and have 3 things you need to see before making a decision one way or the other…

BYND Has Very Poor Upside Potential with Poor Safety and Timing to Boot

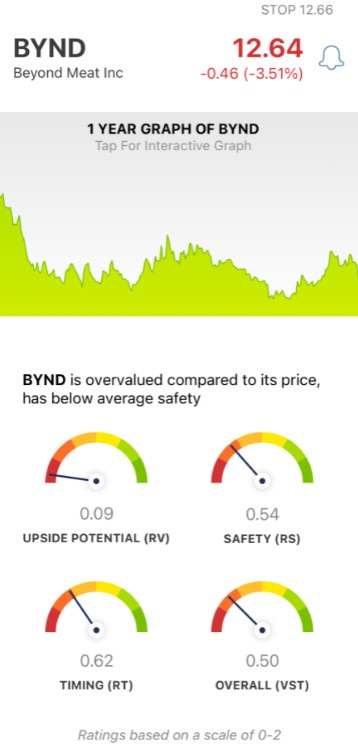

The VectorVest system simplifies your trading strategy by giving you all the insights you need to make clear, confident trades in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00, with 1.00 being the average. Pick stocks with above-average ratings and win more trades with less work. Or, better yet, follow the clear buy, sell, or hold recommendation the system issues for any given stock, at any given time. As for BYND, here’s what we found:

- Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential and AAA corporate bond rates & risk. And right now, BYND has a very poor RV rating of 0.09. The stock is overvalued with a current value of just $1.17.

- Poor Safety: The RS rating is an indicator of risk, and is derived through an analysis of a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for BYND, the stock’s safety is poor with an RS rating of just 0.54.

- Poor Timing: As you can see by looking at how the stock has trended over the last few weeks, the timing is poor for BYND right now - and the RT rating of 0.62 reflects that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.50 is poor for BYND - but is it bad enough to justify selling this stock? Or, should you weather this storm and wait for the company to turn things around?

A clear buy, sell, or hold recommendation is just a click away - get a stock analysis free today at VectorVest and make your next move with confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BYND just delivered abysmal earnings featuring missed revenue, lowered revenue forecast, and profitability problems. As issues start to pile up, the company has very poor upside potential, poor safety, and poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment