Shares of Datadog Inc. (DDOG) have fallen more than 18% in Tuesday morning’s trading session so far. The company delivered quarterly earnings that topped the analyst outlook for the quarter that just ended – that’s not the issue. The problem is in the forecast for the current quarter and the remainder of the year ahead.

The software company provides observability and security solutions for cloud applications, and revenue soared to $509.5 million for the most recent quarter. This was a dramatic improvement from this time last year when the company reported just $406.1 million. Meanwhile, analysts were projecting just $501.6 million.

In terms of profitability, Datadog’s net loss of $4.0 million was slightly better than last year’s loss of $4.88 million. The adjusted EPS of 36 cents came in well above the FactSet consensus of 28 cents.

However, the bears are down on this stock as the future looks bleak – at least, from their viewpoint. Analysts were projecting revenue of $536 million for the third quarter ahead. But, the company itself is just looking to deliver between $521 million to $525 million in revenue.

It gets worse when looking at forecasts for the full year. The company is expecting $2.05 billion to $2.06 billion in revenue for 2023, whereas experts won’t be content with anything less than $2.24 billion in revenue. You can see the obvious disconnect between reality and what analysts are hoping for.

Despite growing revenue by 25% for the quarter that just ended, the negative sentiment around the company’s forecast sent shares tanking. Leading up to this news, DDOG had actually been rallying in the right direction. The stock had climbed more than 49% in the past 3 months.

That being said, what should you do if you’re currently invested in this stock? Is it time to cut losses and move on? We’ve taken a look at DDOG through the VectorVest stock analysis software and have 3 things you need to see before you make your next move one way or the other

DDOG Has Poor Upside Potential, Safety, and Timing

The VectorVest system simplifies your trading strategy to help you win more trades with less work. It’s all based on a proprietary stock rating system that uses 3 ratings to tell you what to buy, when to buy it, and when to sell it.

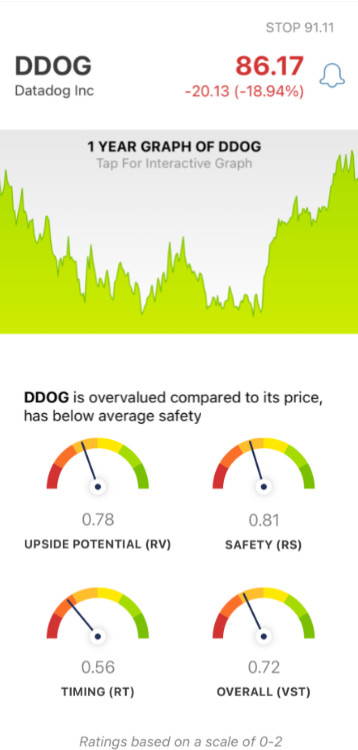

These ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on its own scale of 0.00-2.00, with 1.00 being the average. And, based on the overall VST rating for a given stock, the system even issues a clear buy, sell, or hold recommendation - at any given time! As for DDOG, here’s the current situation:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. This gives you far more valuable insights than a simple comparison of price to value alone. As for DDOG, the RV rating of 0.78 is poor. Further to that point, we see that the stock is overvalued - with a current value of just $21.42/share.

- Poor Safety: In terms of risk, DDOG has poor safety as well - with an RS rating of 0.81. This rating is calculated through an analysis of the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: To make matters worse, the steep dropoff today has reversed the favorable price trend this stock had been rallying on - and now, the stock has poor timing. The RT rating of 0.56 is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

All this said, DDOG has a poor overall VST rating of 0.72. Does that mean it’s time to cut losses and move on? Or, is there any reason for you to hold onto hope that things will turn around quickly?

Don’t let emotion get the best of you. A clear recommendation on your next move with DDOG is available through a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite delivering on revenue for the quarter, the weak forecast for DDOG has sent shares tanking. Right now, the stock has poor upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment