Nvidia (NVDA) stole the show in Thursday morning’s trading session, after a 1st quarter earnings report that shook the financial world up. The stock is currently up 27% as of Noon. Today’s performance is poised to be the biggest single-day rise in market value at over $200 billion.

For the first quarter, the company grew sales by nearly 20% to a whopping $7.2 billion. At the same time, profits skyrocketed 25% to $2 billion. All of this comes from a continued surge in demand for Nvidia’s chips as the brain for data centers responsible for AI.

According to CEO Jensen Huang, we’re currently in the midst of a 10-year transition that will entail a complete overhaul of our world’s current data centers – as they shift towards accelerated computing. This will require data centers to invest heavily in SmartNICs, smart switches, and GPUs – which is where Nvidia comes in.

Because of all this, Nvidia raised guidance dramatically for the current quarter – blowing their previous outlook and even wall street estimates out of the water. While the expectation was that revenue would come in at around $7.2 billion, that figure has been raised to an astounding $11 billion.

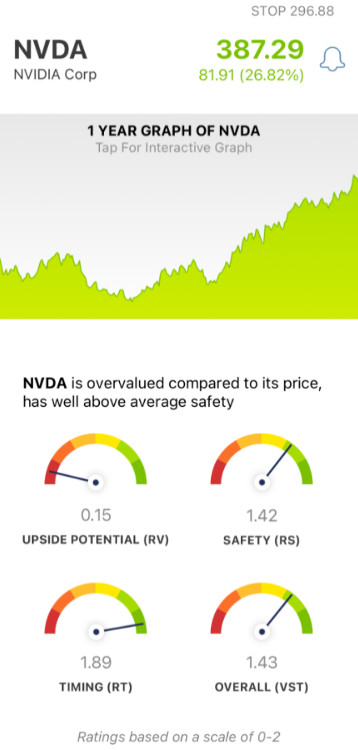

Some analysts have raised their price target to as high as $475. On the other hand, some experts are suggesting that Nvidia is now among the most overvalued stocks on the market – with a market cap of 35 times its revenue. VectorVest calculates the intrinsic value of Nvidia at $37.32 as of today, so it is trading 10 times above its value.

Whatever the case, investors who got in early have witnessed a 175% spike in share price since VectorVest rated it a buy on November 10, 2022. From when we wrote about NVDA in February, the stock has climbed more than $175. And from our discussion on NVDA in August of last year, the stock is up more than $200.

So, what’s the move now – is there still reason to believe NVDA can go higher? Or, has it reached its peak – is it time to take your profits and run? We’ve taken a look at this stock through VectorVest – the most intuitive stock forecasting software on the market. Below, we’ve laid out the 3 things you need to know.

NVDA Has Excellent Safety and Timing, plus a very good Comfort Index

The VectorVest system simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it. No more emotion clouding your judgment, no more guesswork while executing your trades. Just follow three simple ratings to gain all the insights necessary for clear, confident investing.

These are relative value (RV), relative safety (RS), and relative timing (RT), each of which sits on its own scale of 0.00-2.00. With 1.00 being the average, interpreting these ratings is simple and straightforward. And, it gets even easier.

Because based on the overall VST rating for a given stock, the system offers a clear buy, sell, or hold recommendation – at any given time. As for NVDA, here’s what we’ve found:

- Excellent Safety: With that said, the stock does have excellent safety – with an RS rating of 1.42 This is calculated through an analysis of the company’s financial consistency & predictability, alongside debt-to-equity ratio and business longevity

- Excellent Timing: As you can see by looking at NVDA through any timeframe in the past year, the stock has been steadily climbing higher and higher. And the excellent RT of 1.89 confirms that there is a strong positive price trend behind this stock. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year

- Very good Comfort Index:

- This index measures the consistency of a stock’s long-term resistance to severe and lengthy corrections. This index compares the individual stock to the fluctuation of the VectorVest Composite price that is measured on a scale of 0 to 2.00. At a level of 1.37, NVDA’s rating is significantly above average.

All things considered, the stock has an excellent VST rating of 1.43 – despite the very poor price appreciation potential. So, does that mean it’s still time to load up your portfolio with shares of NVDA – or is it too late to get in?

Before you do anything else, get a clear answer on your next move through a free stock analysis today at VectorVest. Trust us when we say you’re not going to want to miss out on this information!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While NVDA has certainly become Wall Street’s darling and doesn’t appear to be slowing down anytime soon, there is very little upside potential. Still, the stock has excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment