Yesterday, Palantir (PLTR) and the Ukrainian government announced that the two parties have struck a deal. Palantir’s technology will be a crucial part of Ukraine’s reconstruction efforts going forward.

The software company empowered its users to make key decisions based on machined-assisted and human-driven data analysis. The use case in Ukraine is to catalog and assess damage to buildings and infrastructure that have resulted from the war with Russia.

After using Palantir’s tech and tools to gain insights, the Ukraine government will be able to set out on the next stage of the country’s recovery. Beyond this, the goal for the two parties is to assist Ukraine in becoming a European digital leader.

As of now, Palantir is already lending a helping hand to Ukraine in the resettlement of refugees. The country’s minister of digital transformation, Mykhailo Fedorov, expressed his excitement to continue developing partnerships with top-notch companies like Palantir. He wants the image for Ukraine going forward to be one that is both bold and digital.

This deal doesn’t come as much of a surprise, as Palantir CEO Alex Karp has shown support for Ukraine since the invasion broke out. He was the first Western CEO to visit President Zelenskyy on Ukrainian soil.

This news sent shares of PLTR 10% higher, but they dipped back down to around 8% as of 11:45 AM EST in Friday’s trading session. When we last wrote about this stock in mid-February, it sat at a modest $8/share. The company was coming off a profitable quarter and share prices were climbing.

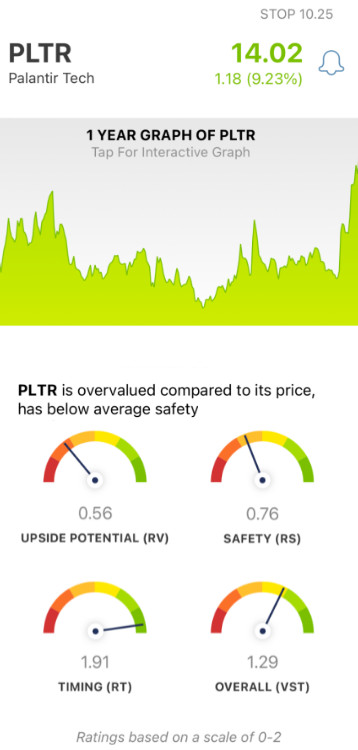

3 months later, the stock has skyrocketed 75% to nearly $14/share. With this momentum, and the news of a deal with Ukraine, is it time to buy PLTR? We’ve analyzed the stock for you using the VectorVest stock analyzing software. Below, we’ve uncovered 3 things you need to see to help you make your next move with confidence.

While PLTR Has Poor Upside Potential and Safety, the Timing is Excellent

The VectorVest system helps you uncover winning opportunities and execute trades on autopilot. You’re given all the insights you need to make clear, calculated decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Following the system couldn’t be more simple. Each of these ratings sits on its own scale of 0.00-2.00, with 1.00 being the average. By pickling stocks with ratings above the average, you can win more trades with less work!

But it gets even easier. Because based on the overall VST rating for a stock, the system gives you a clear buy, sell, or hold recommendation based on the current conditions. As for PLTR, here’s the current situation:

- Poor Upside Potential: The RV rating looks at a stock’s long-term price appreciation potential (projected 3 years out) compared to AAA corporate bond rates and risk. And right now, PLTR has a poor RV rating of 0.56. Making matters worse, the stock is overvalued. The current value is just $2.55.

- Poor Safety: From a risk standpoint, investors need to realize that PLTR has poor safety - as evidenced by the RS rating of 0.76. This is derived from the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one thing PLTR has going for it right now is excellent timing - nearly tipping out the scale with an RT rating of 1.91. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.29 is very good - but is it enough to justify adding PLTR to your portfolio? Does excellent timing outweigh poor upside potential and safety, or is it the other way around?

This was the same conundrum investors faced back in February when we talked about this stock. We helped you find your next move then, and we can do it again now. A clear buy, sell, or hold recommendation awaits you at VectorVest. Don’t miss out on this opportunity - get a free stock analysis today to find out what you should do next!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After the company’s deal with Ukraine, PLTR has excellent timing - but still has poor upside potential and safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment