Shares of Peloton stock (PTON) have been on a steady ride to the bottom, and things just got a whole lot worse. The company voluntarily recalled a whopping 2 million+ bikes on Thursday.

This news sent shares tumbling 9% in the past two days, putting more downward pressure on what was already a negative price trend. The stock is now down more than 15% in the last week alone.

The issue pertains to the seat post on these bikes, which is liable to break unexpectedly during use. This could lead to potential falls and injuries. So, the company pulled the bikes on their own accord after receiving 35 reports of the problem. 13 of these led to some form of injury, ranging from bumps and bruises to a broken wrist.

Fortunately, the solution is as simple as a seat replacement – which Peloton will offer free, of course. However, this isn’t the first time the company has faced backlash as a result of recalls. Just 2 years ago the company was forced to pay out a $19 million fine and recall 125,000 treadmills after the death of a child and a slew of accidents.

This time around, experts don’t suspect the hit to the company will be comparable. There is no fine associated with this recall – and the only financial cost is replacement seats. Nevertheless, this was the last thing the company needed after issuing a warning to investors of a dip in subscribers for the current quarter.

What a fall from grace it has been for Peloton, which sat at a high of $162 just a few Christmases ago. Today, the stock sits at a mere $6.80/share – and we aren’t sure this is the worst of it, either.

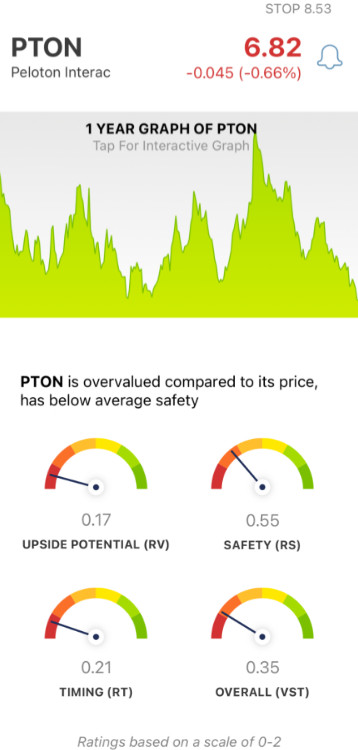

We’ve taken a look at PTON through the VectorVest stock analyzing software, and have identified 3 major issues that shareholders need to see…

Recall Issues Aside, PTON Has Very Poor Upside Potential and Timing With Poor Safety to Boot

The VectorVest system helps you simplify your trading strategy by telling you what to buy, when to buy it, and when to sell it. You can win more trades with less work - and a whole lot less stress along the way.

All of this is possible through the tried-and-true proprietary stock rating system, which is comprised of three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on its own scale of 0.00-2.00, with 1.00 being the average. Based on the overall VST rating, VectorVest even offers a clear buy, sell, or hold recommendation - for any given stock, at any given time. As for PTON, here are the current problems holding the stock back:

- Very Poor Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (projected 3 years out) to AAA corporate bond rates and risk. And right now, PTON has a very poor RV rating of 0.17. While the stock already sits at its lowest point in company history, it’s still overvalued - with a current value of less than $1.00.

- Poor Safety: In terms of risk, PTON has poor safety - with an RS rating of just 0.55. This is derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: As you can see by looking at the recent stock performance, PTON has very poor timing - and the RT rating of 0.21 confirms that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.35 is poor for PTON - so, is it time for investors to cut losses and get out while you can? Or, should you keep holding on in hopes this stock will turn things around in the upcoming quarters?

Don’t let guesswork or emotion influence your decision-making - get a clear answer on your next move with PTON through a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for PTON, the stock was already in trouble - and the recent recall will only exacerbate the problems facing this company. The stock has poor safety, with very poor upside potential and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment