Calls, puts, iron condors, butterflies, straddles, strangles, strikes, bull put spreads, bull call spreads – the jargon alone can be intimidating to beginner option traders, but don’t let it scare you away! Trading stock options can provide flexibility for investors at every level and help them to leverage, protect and manage risk.

Why Trade Options?

Two answers. Leverage and Protection. Leverage means you get more with less. In the case of options, you get the same or greater returns using less of your money.

Options can also provide protection and can serve as a form of an insurance policy just in case something unexpected should happen. Just like typical insurance, it will cost money out of pocket, but when you need it, you’re happy you had it. Just like with typical insurance, it’s better to have it and not need it, than need it and not have it.

Here’s an example:

Facebook was in a strong uptrend, but it had several negative news events throughout the year. If you owned shares of FB, you might’ve been nervous prior to the earnings announcement. One week prior to earnings, you buy a Put as insurance. At the time, FB was trading at $209.36. If you owned 100 shares, you had $20,936 invested in FB and you’d want to ensure that against a major loss. Your Put cost you $512. After earnings, FB plunges to $176.26. You would have been saddled with a $3,310 loss. However, your Put had a net gain of $2,380. Instead of losing $3,310, you lost $930 because you protected yourself with a Put.

When you are trying to learn options, you probably don’t know where to start. We advise investors to focus on the most important, CALLS and PUTS.

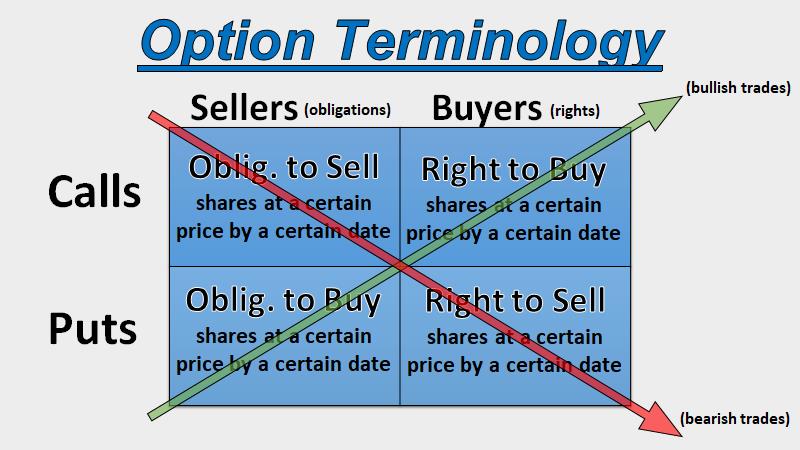

Buyers have Rights. Sellers have Obligations.

Just like if you bought something at a store. The seller is obligated to deliver the item promised in good working order. The buyer has the right to return an item if it is broken.

As an option buyer, you have rights. When you think of the building blocks of options, we start with: •

- The BUYER of a CALL has the RIGHT TO BUY a stock

- That means the SELLER of the CALL has the OBLIGATION TO SELL the stock

- The BUYER of a PUT has the RIGHT TO SELL a stock

- That means the SELLER of the PUT has the OBLIGATION TO BUY the stock

The arrow going up intersects the bullish trades

Buy Call and Sell Put

The arrow going down intersects the bearish trades.

Sell Call (a.k.a. naked call – don’t do!) and Buy Put

If you buy a Call, you want the price of the underlying stock to go up. If you buy a Put, the value of your put increases if the price of the underlying stock goes down. Whether you buy an option or sell an option, you set the exact price in which your rights or obligations kick in.

For now, we will focus on Buyers of Puts and Calls.

The Best Time to Buy Puts

Put options are used to reduce risk. They work the same way insurance does by guaranteeing that you will receive a certain value for an underlying asset even if it goes down to zero. Put options can appear to be expensive compared to home or auto insurance, so they must be used judiciously.

Since Puts go up in value when stock prices go down, they can also be used as an alternative to selling stocks short. A major advantage of using Put options as compared to selling-short is that your risk is limited to the cost of the premium for the Puts. The risk in selling stocks short is unlimited.

The best time to buy a put is when the market and your stock are more likely to go down or already in established down trends. If you are unsure of the trend in the market, our daily market Color Guard can help. Red Light with MTI & BSR falling – Bearish

Use puts when you want to be defensive and protect your portfolio. Market volatility and major market corrections are a time where you would want to buy puts. Buy SPY puts as insurance to protect your entire portfolio. It’s like an insurance policy to avoid losing capital during wild market swings.

Best Time to Buy Call Options

Call options provide the right, but not the obligation, to buy units of 100 shares of stock at a certain price by a certain date. Call options increase in value when the price of the underlying stock goes up.

You’ll want to purchase call options when you seek to reduce risk, gain leverage on buying high-priced stocks, hedge a short position or play a market rally by using Index options.

Buy calls when the market outlook is bullish and when the color guard shows the BSR and MTI are rising.

There are some additional considerations you’ll want to become familiar with when trading options, but options are an excellent tool to have in your trading toolbox. Buying calls and puts gives you the unique power to minimize your risk while increasing your upside potential. They allow you to make money in up, down, and sideways markets. And, they provide the most powerful defense you could use against market volatility. Remember, options are for all investors, not just the pros.

Leave A Comment