Want to learn how the stock market works? In this in-depth guide, the truth about the stock market will be unveiled. You’ll learn about what actually affects the big picture of the stock market – and the role market sentiment plays in how the stock market works.

Any time a bear market is on the horizon, a self-actualizing prophecy begins. Financial analysts with a voice spread their pessimistic viewpoint – despite favorable market conditions still persisting. But, this sentiment being pushed to the masses results in a negative investor sentiment taking hold. The end result? The S&P 500 starts dropping – not because the economy is falling apart. But rather, because people thought it would.

We’re going to guide you through the basics of how the stock market works. You’ll learn what drives the market – earnings, inflation, and interest rates. Then, we’ll explain how market sentiment is intertwined with these technical factors to produce changes in the economy. Buckle up, we’ve got a lot to cover!

Understanding How the Stock Market Works at a Broad Level

Before we can take a deep dive into how the stock market works, we want to explain it at a more broad level. Those who are new to investing or the stock market will benefit from this introduction. And to really do that, we need to take a step backward – and explain what a stock is.

A stock is a financial instrument that represents ownership in a company. When you buy stock, you gain ownership of the said company. It’s that simple. But what does owning a stock mean, really? Are you going to have a say in the daily happenings at the company? Will you be invited to the annual Christmas party? Not necessarily. Most major companies on the stock market exchange have outstanding shares that run into the billions. Becoming a majority shareholder in any publicly traded company is rare these days.

However, owning company stock does mean that you benefit from the increased valuation of that company. As the price goes up over time, your shares are worth more. But, the opposite is true, too. Should a company’s stock price fall, your investment will dwindle. It’s important to understand the risk you take on when investing in the stock market. But, that’s a conversation for another day.

Ok – you have an understanding of what a stock is. So, we want to help you gain a better understanding of how the stock market works at a broad level now. The stock market is simply an exchange where investors like yourself can purchase or sell shares of company stock. It’s an auction-based system where buyers and sellers set their own prices. And, the specific price of a given stock is derived largely from value. Because investors may not agree on the specific value of a given stock, fluctuations in price on a minute-by-minute basis are common. You can purchase a stock at one price, and sell it at a higher or lower price a few hours later. But what causes these changes in price? What are the inner workings of the stock market, and how do they affect our economy as a whole? That’s really what we’re interested in discussing today. So now that you have a bit more information on how the market works in general, let’s go a bit deeper.

A Deeper Look at How the Stock Market Works

Many people who want to learn how the stock market works are simply interested in the basics – which we’ve just covered. However, we’ve seen more and more investors questioning the fundamental inner workings of the stock market. If you came here hoping to gain an in-depth understanding of what affects the stock market and truly drives prices up and down, you’ve come to the right place. Here’s a brief overview of what we’ll cover in the coming sections:

- The technical factors that cause value to rise or fall in the stock market (earnings, interest rates, and inflation)

- The market conditions that create the best opportunity for investors

- The role market sentiment plays in influencing the stock market

What Technical Factors Causes Value to Rise or Fall in the Stock Market?

First, to truly explain the stock market, we have to talk about what causes the value to rise or fall. There are three factors that we want to highlight.

- Earnings

- Inflation

- Interest rates

First, we have earnings. Earnings are the most prevalent driving force for the stock market. We have an entire guide on what earnings is in the stock market. But, to summarize, this is a metric that shows you how profitable a company is in a given period. When a company’s earnings exceed expectations, the perceived value of that company rises – and so too does the stock price. On the other hand, when poor earnings reports are released, value and price fall.

But, earnings don’t paint the whole picture in the stock market. There are two external forces that will dictate where we see a bull market (favorable) or a bear market (unfavorable): inflation and interest rates. We recently wrote a complete guide on what inflation does to the stock market. We also discussed how to hedge against inflation, and provided insights into the best hedge against inflation for these periods. But to summarize, rising inflation is typically an indicator of a bear market. As inflation goes up, stock prices go down. The opposite is true as inflation goes down.

Similarly, interest rates have a unique relationship with the stock market. While they are not necessarily directly related to each other, the stock market and interest rates share an inverse relationship. History has shown that as interest rates rise, stock value goes down. Rising interest rates contribute to a bear market. On the other hand, as the fed lowers interest rates, stock value goes up.

What Market Conditions Create the Best Opportunity for Investors?

Now, having explained the three factors affecting the overall stock market – what conditions create the best opportunity for investors? We’ve tiptoed around the answer a bit – but here’s what you need to know:

As earnings increase and inflation & interest rates drop, the stock value increases. If any of these factors deviate, the stock market will turn.

So, if earnings continue to increase but inflation and interest rates start to rise as well, the stock value drops. Or, if earnings drop while inflation and interest rates stay consistent, the stock value will still drop. The point is, you need these three factors to remain in harmony for favorable conditions to persist. We were fortunate enough to witness (and take advantage of) one of the largest bull runs in history – from 2009 to just recently when the COVID-19 pandemic first gripped the world.

In summary – invest in periods of time where earnings, inflation, and interest rates are optimal and you’ll have success. Now, that’s not to say you can’t see periods of profitability in unfavorable stock market conditions. With swing trading strategies, you can capitalize on short-term price swings and make a killing. The same is true of shorting a stock, or purchasing inverse ETFs. You can even learn how to invest in a recession to preserve your portfolio – or, perhaps even continue to earn profits!

Investor Sentiment in the Stock Market Trumps Technical Factors

Now that you know the main three factors affecting the stock market and how they’re interconnected, it’s time to add one more layer of complexity: investor sentiment. As we detailed in our guide covering what stock market sentiment is, this is a gauge of how other investors in the market feel at any given time. And as you may already know, perception becomes reality in the stock market. If investors have a negative outlook on the stock market at large and suspect a bear market is coming, this will manifest itself.

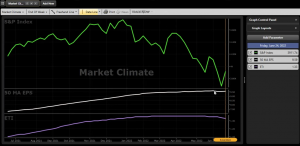

Just take a look at our current market climate charted against EPS. You’ll see that while EPS (earnings per share) have slowed, they have not started trending down. So, why are we seeing a bear market come to fruition? Investor sentiment! The financial professionals in the industry with a voice are all calling for a bear market. They have the ability to move the market with this sentiment. Earlier, we said that earnings drive the market. And to a certain extent, that’s true. But investor sentiment trumps logic and facts. Because inflation and interest rates are suggesting a bear market could come in the future, people are jumping the gun and behaving as if a bear market is already upon us. This is leading to the current volatility we are experiencing.

Understanding How the Stock Market Works, How Can You Be Successful as an Investor?

That just about concludes our explanation of how the stock market works. But, chances are, you’re now left more bewildered than before reading this article. You know now that you can stay on top of every technical indicator – but there would still be factors you aren’t taking into account in the form of investor sentiment.

That’s why you need the help of a stock analysis software to eliminate guesswork, tune out the noise, and grant you clear insights into whether you should remain in the market or pull out. At VectorVest, we’ve simplified investing for you. You can gain clear insights into investor sentiment at any given time right from your dashboard. And, we even give you a clear buy, sell, or hold recommendation for any given stock – at any given time. No more emotion in your decision-making, no more guessing games. Just trust the VectorVest system and start winning more trades on autopilot. We even help you identify opportunities with ease. Just pull up our list of hot stocks, pick the ones we’ve ranked the highest, and time your entry/exit to perfection. If you want to see what it looks like in action, take a look at our analysis for the most searched stocks here. Or, get a free stock analysis for any company on the market. We’re confident you’ll be hooked, and won’t want to go back to investing the old way.

The Stock Market Explained – Wrapping Things Up

That covers our breakdown of the stock market explained. We hope this deep dive into the inner workings of the stock market has granted you clarity. In summary:

- Earnings drive the market. Increasing earnings, coupled with low inflation and low-interest rates, creates optimal conditions for investors.

- Investor sentiment trumps facts and logic, and perception becomes reality. Investors need to track not just the technical elements of the stock market – but the emotional elements as well.

- With a software like VectorVest, making emotionless, calculated decisions is easy. You can trade in confidence with insights into current market sentiment – along with our unique value, safety, and timing metrics.

What you should do next…

- Get our latest blogs delivered right to your inbox, subscribe to our newsletter.

- The market moves fast! Get our most current evaluation of this stock with our FREE stock analysis tool.

- Looking for stock picks? Not sure if now is the right time to buy/sell? For a limited time, enjoy the full benefits of a 30-day subscription to VectorVest for only $9.95 (usually up to $139/month) . Get access to our full list of screeners showcasing our top stock picks that tell you exactly what to buy, when to buy, and when to sell.

Leave A Comment